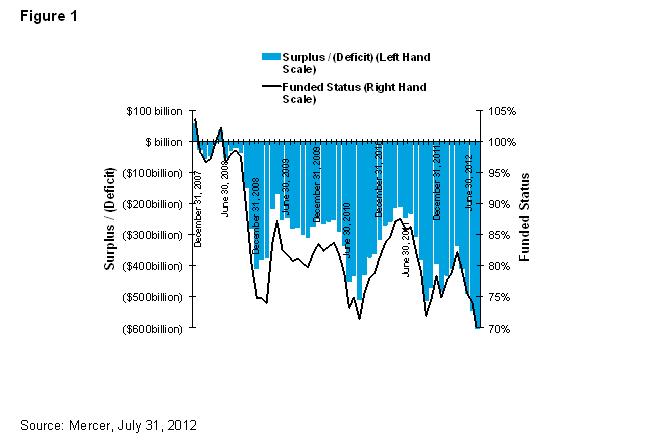

The aggregate deficit in pension plans sponsored by S&P 1500 companies

grew $146 billion during July, to a record high $689 billion, according to new

figures from Mercer[1]. This deficit corresponds to a record low aggregate

funded ratio of 70% as of July 31, 2012, compared to a funded ratio of 74% as of

June 30, 2012, at which point the aggregate deficit was $543 billion.

Although US equity markets rose 1.4% during July[2], discount rates[3] fell another 30 to 55 basis points resulting in

liability increases ranging from 3% to 11% during the month. The continued fall

in US Treasury yields and the narrowing of corporate bond credit spreads led to

discount rates hitting a new all-time low for the third consecutive month.

gThis record deficit proves that pension funded status

volatility is showing no sign of abating, breaking the previous low of 71% at

the end of August 2011,h said Jonathan Barry, a partner with Mercerfs

Retirement, Risk & Finance consulting group. gAs we have turned past the

halfway point for the year, sponsors really need to take a close look at how

these deficits might impact their 2013 financials. Absent a significant rise in

rates over the next five months, sponsors will be looking at higher year-end

balance sheet deficits and P&L expense for 2013.

gNCR's recent announcement of

accelerated cash funding and offering terminated vested participants a lump

sum payment shows that options beyond funding the minimum required can still be

very attractive,h said Kevin Armant, a principal with Mercerfs Financial

Strategy Group. gSponsors also need to take a close look at the impact of market

conditions and recent legislative changes on their funding strategy. Funding

stabilization, enacted as part of MAP-21, will give sponsors an opportunity to

lower near-term contribution requirements. But companies need to also consider

the true economic deficit they are now facing, and may want to contribute more

than is now required in order to help address this record deficit.h

Mr. Armant added: gThe impact

of higher Pension Benefit Guaranty Corporation premiums and the potential

ability to borrow at low rates to meet funding requirements come into play as

well and comparing the alternatives requires careful analysis.h

Mercer estimates the aggregate

combined funded status position of plans operated by S&P 1500 companies on a

monthly basis. Figure 1 shows the estimated aggregate surplus/(deficit) position

and the funded status of all plans operated by companies in the S&P 1500.

This is based on projections of their reported financial statements[4] adjusted from each companyfs financial year-end to July

31 in line with financial indices. This includes US domestic qualified and

non-qualified plans and all non-domestic plans. The estimated aggregate value of

pension plan assets of the S&P 1500 companies at December 31, 2011, was

$1.45 trillion, compared with estimated aggregate liabilities of $1.93 trillion.

Allowing for changes in financial markets through the end of July 2012, changes

to the S&P 1500 constituents and newly released financial disclosures, the

estimated aggregate assets were $1.57 trillion, compared with the estimated

aggregate liabilities of $2.26 trillion as of July 31, 2012.

Notes for editors

Unless otherwise stated, the

calculations are based on the Financial Accounting Standard (FAS) funding

position and include analysis of the S&P 1500 companies.

About Mercer

Mercer is a global leader in human resource consulting and

related services. The firm works with clients to solve their most complex human

capital issues by designing and helping manage health, retirement and other

benefits. Mercerfs 20,000 employees are based in more than 40 countries. Mercer

is a wholly owned subsidiary of Marsh

& McLennan Companies (NYSE: MMC), a global team of professional services

companies offering clients advice and solutions in the areas of risk, strategy

and human capital. With 52,000 employees worldwide and annual revenue exceeding

$10 billion, Marsh & McLennan Companies is also the parent company

of Marsh, a global

leader in insurance broking and risk management; Guy

Carpenter, a global leader in providing risk and reinsurance intermediary

services; and Oliver

Wyman, a global leader in management consulting. For more information,

visit http://www.mercer.com/. Follow Mercer on

Twitter @MercerInsights.

©2012 Mercer LLC, All Rights Reserved